If you don’t know all the costs, you can’t make an informed investment decision. Oftentimes, what we get from estate agents and ads are the surface-level details. All the hidden costs, which actually end up killing the deal, are not made obvious to you as the investor. Therefore, we have to find out what these hidden costs are, specifically for multi-lets.

Let’s look at an example.

This is a really nice block of six units in the Rosettenville area. On the surface, the deal looks very attractive. The description that the estate agent has given me says the net return is 15%. I’d like to understand how they got that.

The agent also mentions that it’s fully let, well maintained. Rates and taxes of R2 400 and no need to make any kind of renovation estimates. Again, I need proof of all of this.

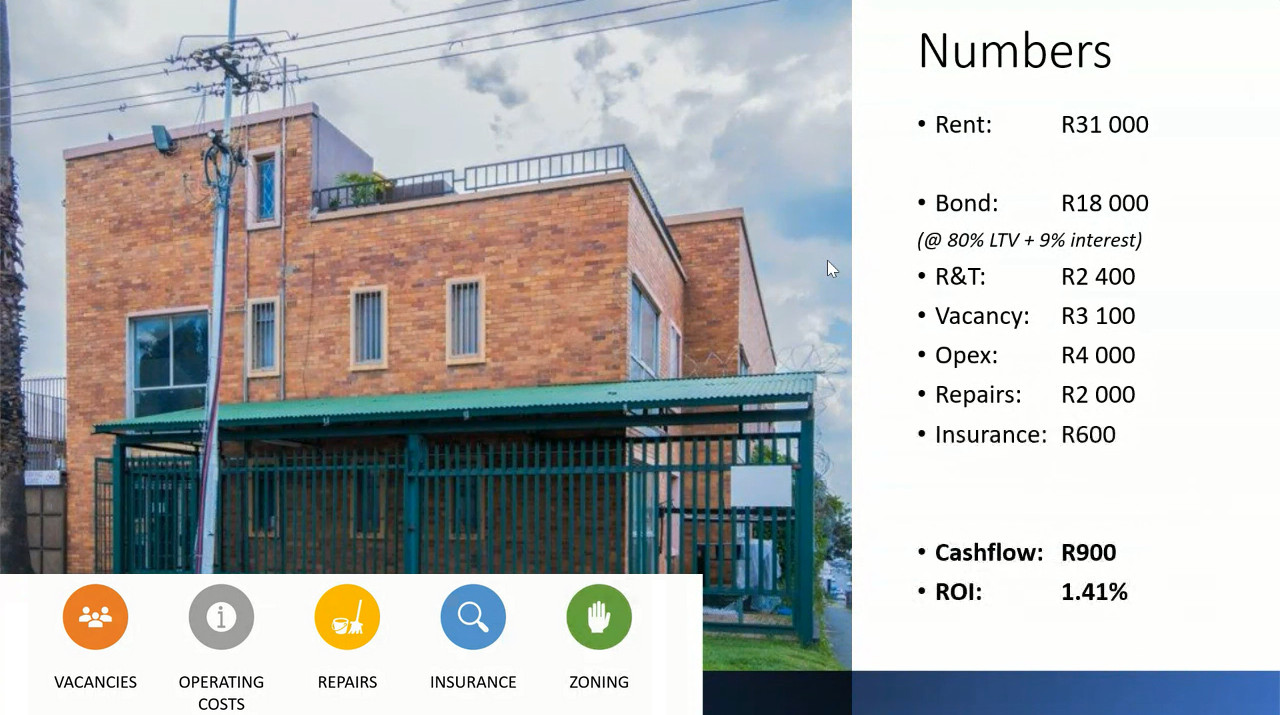

This is the only information we’re given and based on this information; what most people would do is they break down the numbers like this:

It’s a no brainer. Makes sense. That is what has been advertised by the agents. That’s how most investors analyse the deal. Now, let’s include some of the hidden and variable costs and see what happens.

Vacancies

With student accommodation market, for example, you’re almost always going to have two months where you have zero rent. In November and December, students take go on break. That might be a bit different now because of Covid, but for the most part there’s still two months of the year where a student does not rent.

If, for example, you can rent it out as an Airbnb during student holidays, then you can recover those losses. But if not, you have to make sure your numbers work on 10 months, not on 12 months. You would need to allocate a vacancy provision because that’s going to be my void and maintenance budget for this deal.

Operating costs

Water and electricity are obvious. They’re usually included in the rent unless you’ve got your pre-paid meters. That’s why prepaid meters are critical.

Surprisingly, one of the more expensive hidden maintenance costs with student accommodation is door handles. Most doors are opened once or twice per day, but when you’re in a student accommodation there are shared rooms and facilities, like the bathroom. The key and door work more than normal, so you replace them more often.

If you don’t know this, you won’t even know how to budget and cater for it in your research numbers.

Insurance

Insurance is absolutely critical. I would feel very uncomfortable if I had a building without any insurance especially a multi-let. If there’s some sort of disaster and it burned down, at least I get coverage that they will rebuild the house. Insurance can also cover geyser bursts. They’ll give you a whole comprehensive plan.

You can even get rental insurance, which is which is really interesting.

Zoning

How much does it cost to sectionalise? To subdivide? To register as a commune for res to mixed-use? How long will it take? Tough questions to put answers on, but these are the costs that you have to try your best to uncover. You will have a much more realistic perspective.

Let’s re-look at our earlier deal, but include the hidden maintenance and operating costs that we can have.

When we take everything into account, it’s not R10 600 total cash flow, it’s R900! That leaves you with 1.41% return on investment (ROI). Unfortunately, a lot of people buy on the first pre-hidden and variable costs numbers. They buy on the assumption that I’m going to be making R10k per month and then all of these hidden costs set them back.

I’m currently going through my first sectionalisation of a block of nine units. I’m estimating about R90k in total for the architectural and town planning work. Timeline is probably 12-months at best case, maybe 18 months.

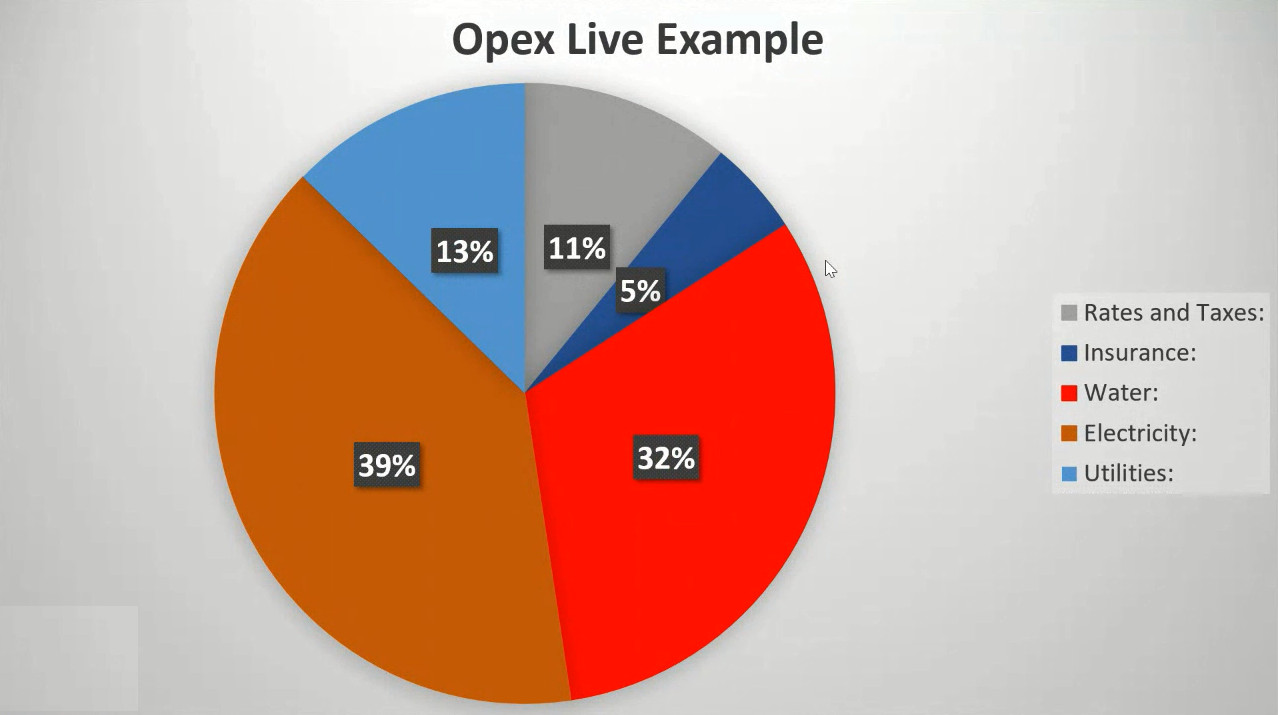

Finally, this chart shows you the volatile nature of operating costs.

The pie chart is detailing the percentage of different expenses on a given building. You can see that of the total expenses, about 11% is going to rates and taxes. Five percent is allocated to insurance and 13% is allocated to utilities.

My two greatest expenses, water and electricity, are the variable costs. Those are the ones that fluctuate with use. The others don’t fluctuate. So about 70-75 percent of the expense base that I have is being allocated towards a cost that could fluctuate. That is the need for electrical meters and why I always recommend in getting prepaid electrical meters. Regarding water, what I tend to do is push that back onto the clients or the tenants account. At the end of the month, I take the water bill and divide it equally among the tenants. They have to pay that in addition to their rent, which is relatively common in the area that I invest in.

These are just some of the costs that you have to be aware of. Always be mindful about the hidden and variable costs that could kill your deal not just before you purchase, but once you own the property.