Where should I buy property investments?

This is the million rand question. To succeed in the property investing game, you need to become an expert in whichever property investment area you choose. You should know your area like an estate agent or letting agent.

Map the areas

Start by mapping the areas. Print a map of your area of choice and sit with an estate agent to find out which are the green (good investments), yellow (ok investments), red (bad investments – socio-economic problems, property values dropped…). With a coloured marker, colour the areas that are green, yellow and red. When an estate agent brings a deal to you, you can compare it to your map and determine if it is a go to area or not.

Online research

Next, research the area online and get a sense of the market. Go to Property24 and research the average prices of properties in the area. For instance, look for the average 2 bed properties for sale in your area. How many properties are for sale? What is the average asking price? What is the condition of the properties? This will give you an indication of your competition and also the supply/demand ratio.

Next look at the same type of property but for rent. How much is the average rent? How many properties are for rent? Get a sense for the market in that area and determine what the gross yield of the properties are.

Read: The difference between gross yield and net yield

Step 2, use tools to get data and make an informed decision. TPN is a great source of area information for property investors. I’ve focused on one of TPN’s reports, known as a suburb report, which details information about the tenant profile in a suburb.

Below is a break-down of the mission critical information I use to make informed investment decisions.

- Existing property demographics

This section details what kind of properties are common in the area, things like; flats, flatlets, freeholds or others (as well as the sizes of the properties) and indicates what could be in high demand in the area.

- Existing household demographics

This indicates what kind of languages, education level and income the typical household in the suburb poses. It can give you an indication of what kind of tenant you will have and what the potential risk factor might be.

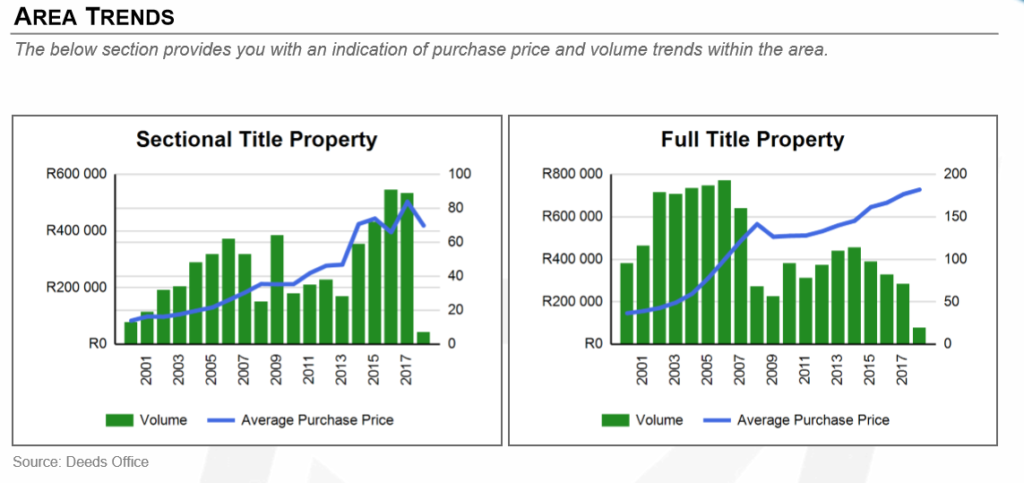

- Area trends

Which indicates what the capital appreciation (blue line) and the volume of transactions (green bar) a particular suburb might possess. As the below shows, the appreciation of properties in the area is apparent, but the volume might be a down-side.

- TPN rental payment index and goodstanding ratios

This indicates what the risk factor might be. As shown below, the rental payment index tells you the likely-hood of a tenant defaulting. At time of writing this (Jan 2019), the national average of goodstanding in SA is 15%, meaning that on average in SA, tenants are on time with rent 85% of the time. The below image indicates which areas are;

- Inline with the national average (yellow)

- Below the national average (orange and red)

- Above the national average (green)

This section also explains how the goodstanding ratio is determined and where the risk lies, i.e. with non payment, partial payment or late payment.

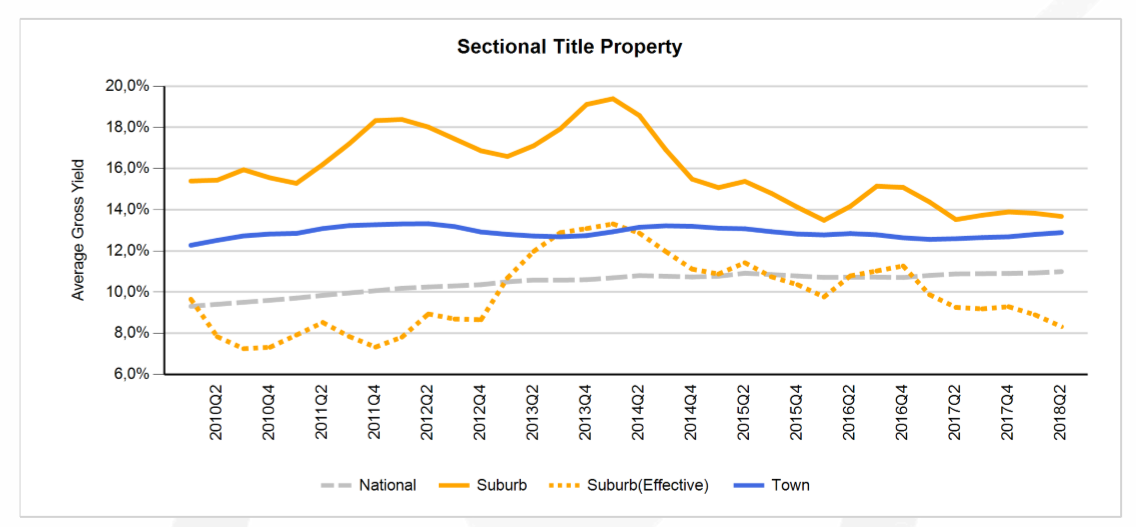

- TPN yield information

This section gives you an indication of what the gross yield (solid yellow line) and effective yield (dotted yellow line) for the suburb might be. An effective yield is your gross yield minus your default rate and is a better reflection as to what the suburbs yields might be.

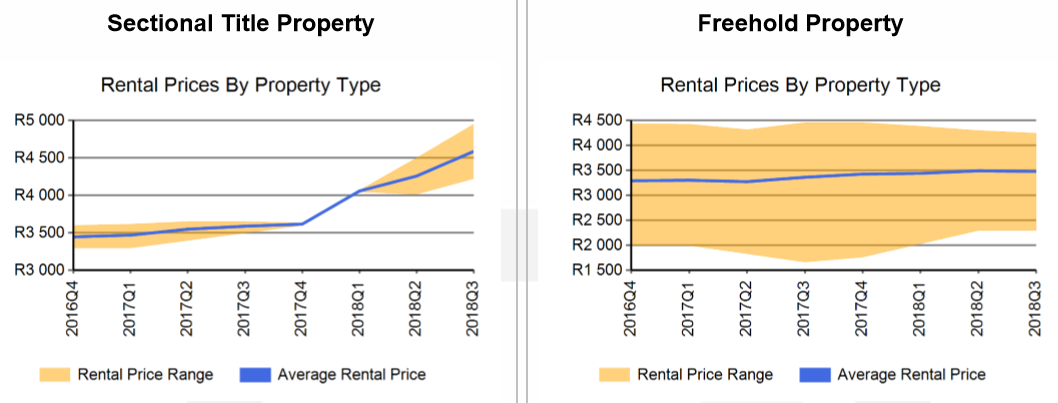

- TPN rental price index and price distribution

The below indicates what the achievable rental for the area and property type is. This information must be confirmed and double checked by an experienced, impartial letting agent.

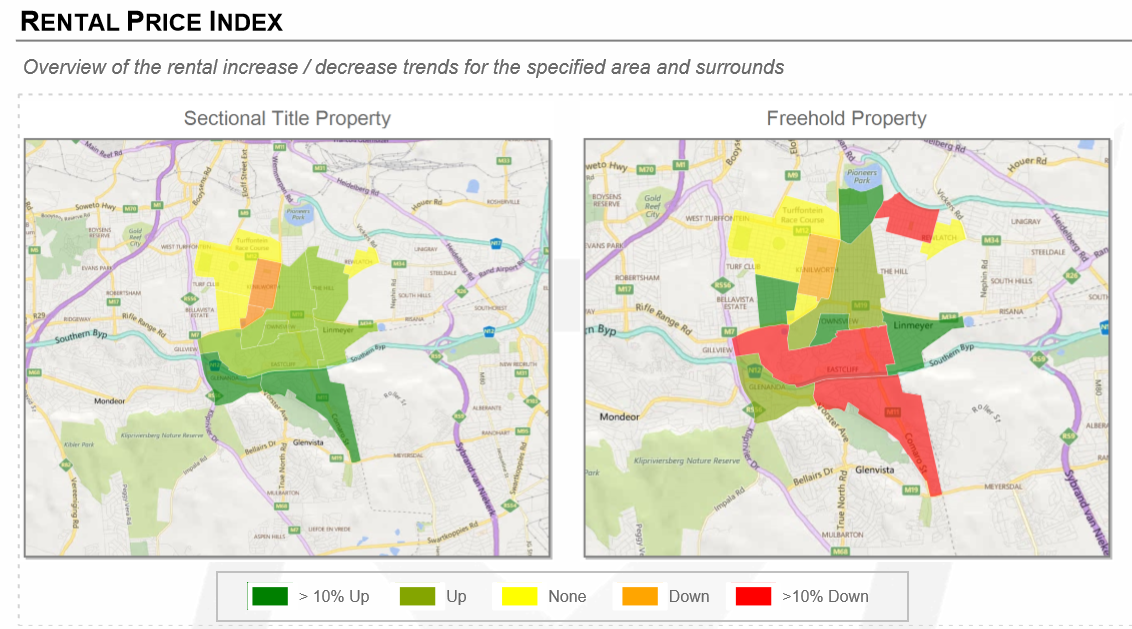

- Rental price index

And finally, the below is an indicator whether an area might experience a rental escalation in the years to come. The red areas could experience a decrease in rental price and the green areas could experience an increase in rental price. The coloured legend below will give more detail regarding the amount of fluctuation an area may have with regards to rental prices.

TPN has a lot more reports that one can make use of. The point is that before you make a buying decision, you need to ensure that you have all the facts. You need to make decision based on data, not opinion. It is important to do all 3 of the above steps, because only listening to the opinion of the Estate Agent, or only looking at the report without context, could be dangerous. Make sure that you understand the Estate Agents opinion of the area and couple that with data from TPN and you will have research an area like a professional.

Ask local experts

Armed with this information, you can now interview the experts. Call the local experts (i.e. letting and estate agent) and ask:

- What kind of property is selling quickest (i.e. 2 bed, 1 bath, with a small garden)? – this will tell you what the safest property type is in the area.

- What type of stock is best in the area? – this will help you determine what is the best investment choice. If the area favours 2 beds, 1 baths, then you know if you buy a 2 bed, 1 bath in the area, you have a high chance of selling it.

- What kind of rentals can I expect? – will allow you to determine the gross yield and whether the area is worth pursuing in more detail.

- What the average resale value and timeline is? – this will tell you a realistic resale figure plus what kind of holding period you should expect to resale. If a property is going to take 3 months or 12 months to sell, you need to know that, because it can drastically affect your profits.

- What kind of features are popular in the area? – perhaps the people in the area really want to have swimming pools and entertainment areas. It’s important to know what the market wants and what they are willing to spend extra on.

- Where must I stay away from (red areas)? – this will guide your energy into focusing on the right areas and avoiding the wrong ones.