One of the most common questions I get is how do you deal with bad tenants. If you’ve followed me for a while, you know that I’m a big advocate for inner city and low-income investing. Those areas attract good returns and yields but also come with a little bit of risk because the people that you’re renting your property out to are those who are most easily affected by drops in the economy and financial constraints. For instance, I lost roughly 40 percent of my property income during lockdown in 2020 because all of my tenants were those who were affected by most of the job losses.

My first bit of advice for any property investor looking for answers on how to deal with bad tenant’s is don’t have any bad tenants! Make sure that before you get to that stage of having a bad tenant, you have vetted the person and you’ve determined the risk. Get your vetting process correct from the beginning, then you won’t have evictions to deal with.

With that being said, I always recommend that you get a managing agent in – someone who has got experience vetting tenants. The way that I do it is I’ll have my letting agent get all the due diligence information. That’s information like the prospective tenant’s salary, bank statements, credit report, etc. The managing agent then sends it to me to give final approval.

I like to have them do that work so that they can kind of filter out the bad tenants and just give me one or two good ones to look at. I can then make a decision based on the credit score report.

Next, I want to show you examples of a good tenant versus a bad tenant application. The first credit report is from a bad tenant or one that I would not allow into my building. The second credit report is from a decent tenant with relatively low risk.

Note: Credit reports contain a lot of sensitive information about the specific person such as their name, contact details, employment history, debt reviews and outstanding debt. For that reason, I cannot share a lot of the information with you because I must protect the individual’s privacy and data. I will just share with you some non-personal information.

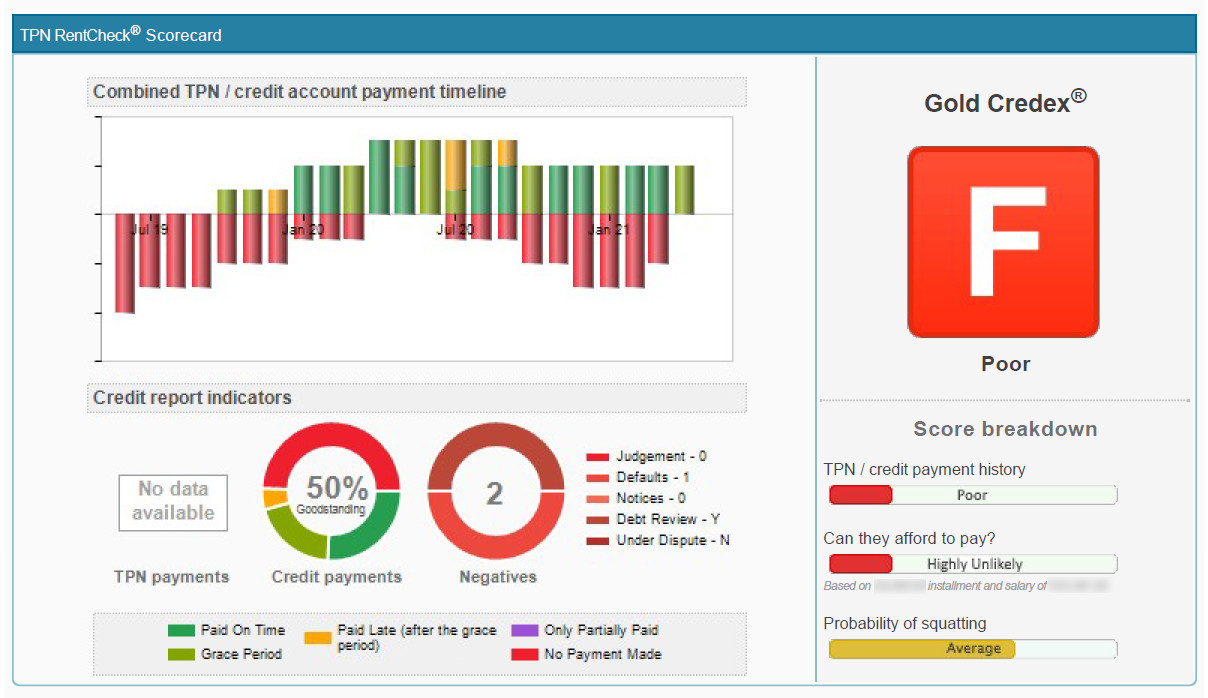

Example of a Bad Tenant Application

This is probably the most important page that I will look at when I’m considering whether I want to bring in someone or not.

First, TPN gives some sort rating from A to F, with an F-score probably being the worst. I know immediately I would not even consider this person. Maybe it could be that this report is out of date or they’ve got, let’s say, a judgment against them that should be overruled. But they just haven’t gotten through the process yet. That’s something that I would maybe consider. But this is not looking good. They’re getting an F-score, which means that their payment history is poor. Can they afford it? Highly unlikely.

The probability of squatting is average. If we look at their credit card payments, 50 percent of the time they are making no payments and then the other fifty per cent is a split between paid on time, paid within the grace period and paid late. She currently does have some defaults and she’s under debt review.

You can also see the months that she did not pay versus the months that she did pay, which probably gives you an indication of how she might likely pay you as a landlord. I think it’s a very negative report and this would be an immediate disqualification from my perspective.

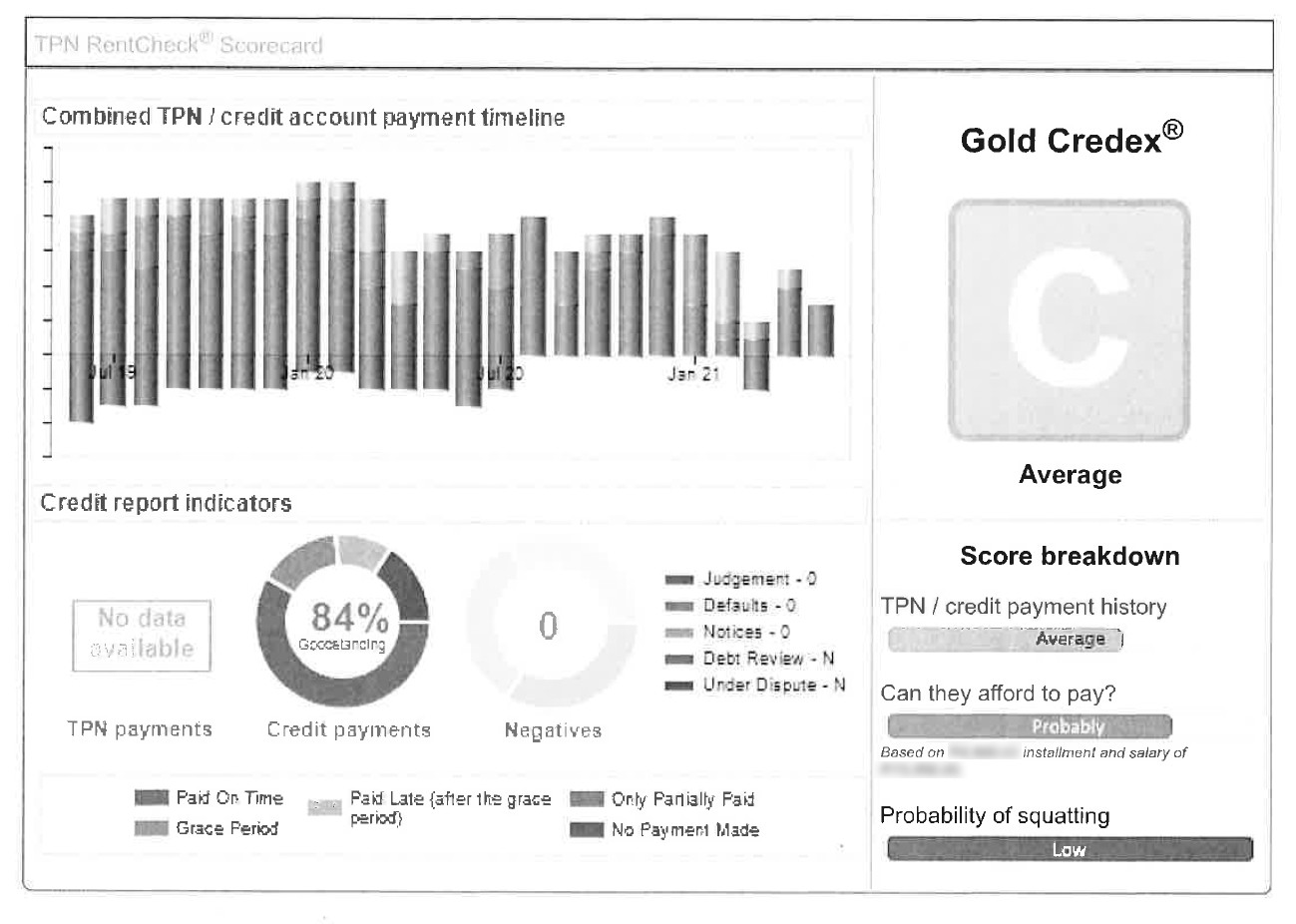

Example of a Good Tenant Application

Here is a credit report of a tenant I really liked.

She also gave bank statements, her signed letter of employment and put a lot of effort into it.

You can see that she’s got a C-score, which means that she’s an average payer and probably can afford. There’s a low level of her squatting in terms of her credit card payments. Eighty-four percent of the time she’s on good payments and a couple of months she’s short. That’s pretty normal. That’s why I budget about 8-10% vacancies with all of my deals, because I’m very aware that there’s some months that the tenants are going to be short.

This is not a tenant that is zero risk. There’s still some risk but if you compare tenant one, the F-score versus this tenant with the C-score, you can see a significant reduction in risk. This is the kind of tenant that I would place, assuming that they pay everything on time and will carry on as normal. If they do start to miss payments, then you follow the eviction process by sending a letter of demand and slowly but surely, getting them out of your property.