Even though trusts are a very popular investment vehicle, they are inefficient and mostly costly from a tax point of view. They are good from a protection point of view, but it’s actually the least effective for investing. To help you understand why, we asked tax expert and property investor, Thierry Hector, to give us a practical example.

————————————————–

By Thierry Hector

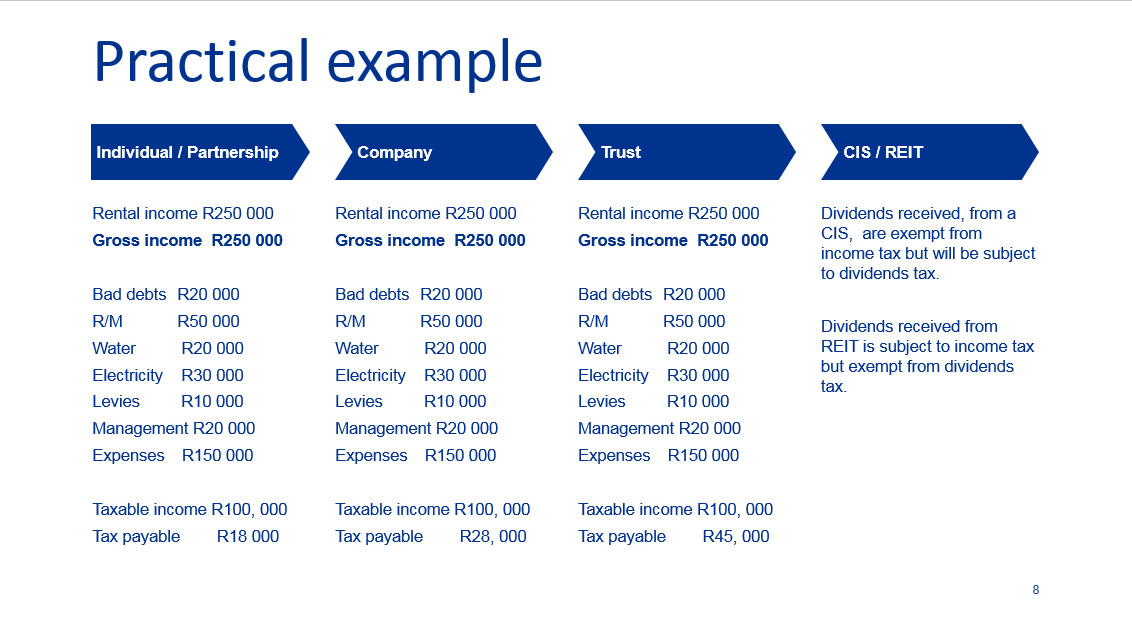

I would have done each tax scenario separately, but I thought having a side-by-side view is easier to look at. In the first scenario we’re assuming the taxpayer is either an individual, company or trust earning a rental income of R250 000 per year. To earn that income, the following assumptions are made:

- you had to make expenses of repairs, maintenance, water and electricity, levies and management fees

- the tenant doesn’t pay you rent to the amount of R20 000 in each case.

Basically, what this shows is that at lower levels of income, the individual partnership is the most efficient structure, and this is because you’re in that lowest tax bracket of 18%. If we move on to the company, it follows with 28% percent and the trust with 45%. We won’t go through the CIS or the REIT as that is beyond the scope of this example.

Now look at the trust. It will have a rental income of R250 000 but will have all these expenses. What will happen is the trustees will come to an agreement and distribute that R100 000 just before year end. The trust will then have a deduction of R100 000 and then at the end of the year, it will have a tax liability of zero. However, that R100 000 will then be distributed to the beneficiaries and they will have to include that R100 000 in their taxable income to be taxed at the respective tax rates.

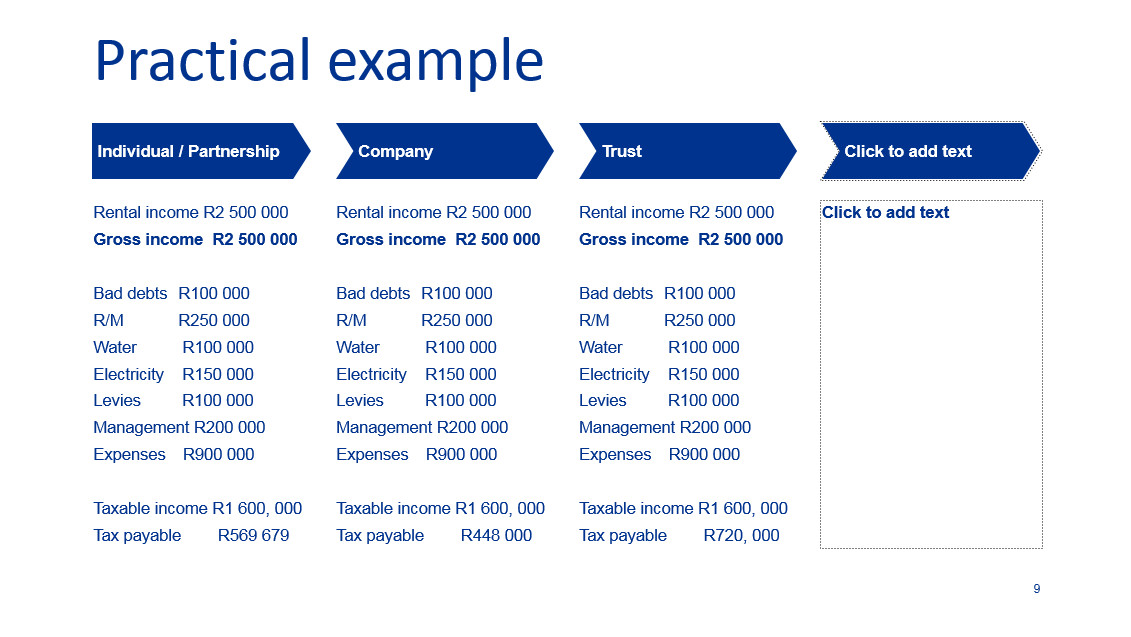

Let’s flip things. We have now increased the rental income to R2,5 million in each case and increased the value of the expenses at a similar ratio.

At the bottom you’ll see that the taxable income in all cases is the same. However, the tax payable changes substantially. You’ll see the tax base for an individual is around R570 000, whereas the tax base for a company is around R460 000. The important thing to note is that once the money is in your individual hands, you can do whatever you want with it. If you still want to take the money out of the company, you’re going to be taxed further. That being said, if the individual or the company is earning a lot more money, this difference just becomes even more substantial because the company is working with a fixed rate, whereas the individual is on a sliding scale.

Taking money out a company

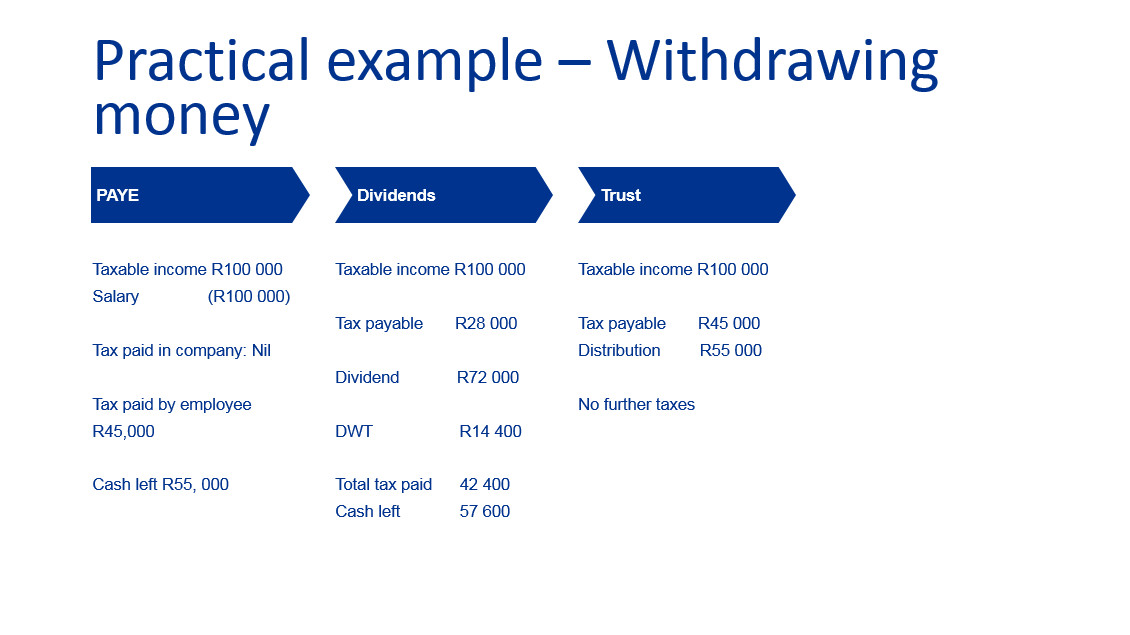

I want to show you the different ways of actually pulling money out of the company. There are many different ways and some which I don’t really advise. The two main ways in which you can pull money out of company is either paying yourself a salary or declaring dividends. I’ve put a trust there so we can show a comparative number.

In this case, we are making the assumption that the individual is already in the highest tax bracket and in each case, the entity is making R100 000 taxable income. If the company pays you a salary, the company receives a deduction of R100 000. That’s why you’ll see tax paid in the company of nil. Whereas when an employee receives the income, they

- will have to include that amount in their taxable income or tax return and will

- have to pay at a rate of 45%

- have an amount of R55 000 left over to use as however they want to.

Now, let’s Iook at an example where a company has R100 000 taxable income tax at a rate of 28%, leaving R72 000 left in as equity.

The company decides to distribute the R72 000 to the shareholders and this will attract a dividend tax rate of 20% on the R72 000, not the R100 000. You’ll be left with an amount of R57 600 where the shareholders can go spend on whatever they want and never again be taxed unless they go invest in something else and so forth.

There you have it. I hope that makes it clearer why taxes are less efficient for investing. If you’re interested in getting more practical with property, you can join our online Property Bootcamp or get a 1-on-1 coaching experience.