Seller financing is a very, very interesting opportunity.

Let’s just explain what this means exactly. Seller financing is when the seller pays the bond instead of involving a financial institution. So, you as the buyer get into an agreement with the seller and the seller becomes your financing option instead of going to the bank. You’re leaving the bank out of this, you’re just going into an agreement with the seller.

Let me show you with a an example of how this would work.

Imagine that you’ve got a distressed seller – someone who has a property that’s in bad condition. You can see their house is broken down and this person is distressed. They want to get rid of this asset. They’re motivated because their property is in bad condition. That is the ideal situation for self-financing.

What you could do as the buyer is come to this person say to them:

“You know what, I’m not going to buy the house, but let’s get into an agreement and I’ll pay to renovate the house. I’ll put it in, let’s say, R150 000 of my own money and I’ll help you fix your property so that it is in good condition, upgraded and is market-value related.”

What you can then do is sell the property for a lot more than what the seller would have sold it for if you had left it in that condition. Let’s say after all expenses, the profit of this deal is R100 000. Essentially, what you can then agree upon is to split that profit 50/50. So, you as the investor are not having to buy the property. You don’t have to go to the bank to get a loan and don’t have to do any of that stuff at all. What you’re doing is committing R150 000 to be able to renovate the property, bringing it back to market condition and selling it at a much higher price than the seller would have been able to sell it at.

Whatever the additional profit is you split 50/50, which means instead of buying the property, you’re only spending R150 000, yet making R100 000 net profit plus your R150 000 back.

It’s a win-win situation. The seller wins because they sell for higher. They make a little bit more out of the deal. You win because you don’t have to buy the property, but you make profit.

Seller Financing Costs

For starters, the legal contracts are very important. You don’t want to invest R150 000 into this person’s house and then they run away. They’re going to sell the property with an estate agent and they exclude you out of the deal. You don’t want to help somebody renovate their house and then they walk away with the profits. You have to make sure you’ve got a very, very strong legal contract.

For renovation costs, you can go different avenues of raising that money. You could use private investor’s, get a personal loan or raise equity out of your property.

What’s powerful is that you don’t have to use the bank. You can use the seller as your financier.

Risk

This is a very high-risk deal. If you do not have trust with the seller or you don’t have the right legal contract in place, please don’t do this deal. As I’ve mentioned before, if you do all the work, you put all the money in, you renovate the property and they run away with it, there’s not much you can do even with a legal contract.

Even with a legal contract you must be careful of this deal, because if the person does decide to not pay your profit, you’re going to have to follow a legal process to try and get them to pay.

All I’m saying is this is an option. I would only do it with someone I’m very close with, like a friend, a family-friend, a family member or someone who I have intimate trust with. That’s the only time I would do this deal with this kind of strategy because it is high risk.

Real Example

Let me show you a quick example.

This is a seller-financed deal between a father and daughter. The father’s got an old house that’s just run down and he was going to sell it for much less than what it was worth. But his daughter said she will pay for the renovations and then they’d split the profit.

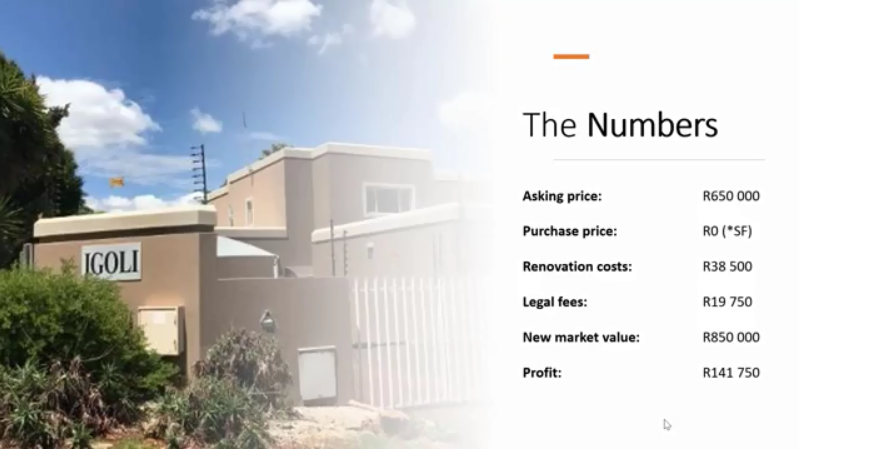

The asking price of this property in its current condition was R650 000. Obviously, the daughter didn’t have to pay anything for the purchase price because she wasn’t actually buying it, just putting in the renovation cost. She put in just under R40 000 into the property. What I can say is that the value that they added was a lot more than R40 000.

Her boyfriend is a builder, so he was able to get all the materials really cheap and he worked for free and didn’t include his labour cost. In actual fact, the renovation costs are probably like R100 000 in terms of the value added. But you’ve got to use the resources that you have, right?

This specific lady was dating a construction worker. Her dad was in a situation where he wanted to sell, get out and move to the coast and wanted to get rid of the property. So she saw a perfect opportunity to leverage both people’s skills and make a nice little profit out of it. She put about R20 000 ran into legal fees to make sure that there was a good contract between her and her dad. The new market value, because of the renovations that her boyfriend did, the value of the property was now R850 000. After all expenses, the additional profit on this property was R141 000 which she, her dad and boyfriend split equally. They all walked away with a nice sizable bit of additional income.

You can see how just being a little clever with how you’re going to work on your projects together with whatever resources you have, you can start making quite a nice lump sum of profit.

Seller financing works really well. When you’ve got a distressed seller and a distressed house, you can then pay for the renovations to buy the property. Remember to make sure that you’ve got a really airtight contract in place to make sure that it’s done fairly and done in the right way.