1. What is cash flow?

Cash flow is property jargon for monthly profit. Imagine you have a property that makes R10 000 rental and your monthly expenses are R8 000. Then your cash flow (i.e. profit) is R10 000 – R8 000 = R2 000 profit. This is known as a positive cash flow situation. If your expenses are more than your income, it means you are making a loss, or in property terms, a negative cash flow situation.

Most people are conditioned to think property must cash flow negatively for the first few years. When I bought my first property, I was losing money every month. My monthly expenses were R10 000 and my rental was R7 500. This meant that I was losing R2 500 per month. I thought it was normal. Everyone told me that is how property works. You lose money for 5 years and then it starts to make you money.

Then I got introduced to a property coach who taught me that positive cash flow not only exists, but is a MUST if you want to become financially free!

Watch now: Replacing your income with property

If you want to be successful in property, you need to find deals that cash flow positively from day one.

How to work out the cash flow of a deal

Like in business, there are two key elements to working out the cash flow; income and expenses.

In property you can receive different types of income. For instance, you can earn income from renting the house, renting a room, renting a parking spot or an additional storage room. You can even rent out advertising space on your property if it is zoned correctly and located in a business district.

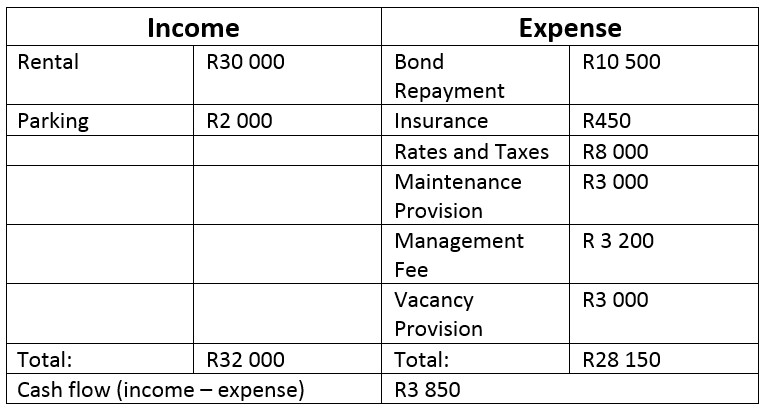

Operating expenses in property include any cost associated to the monthly upkeep of the property. This includes things like; bond repayments, insurance, rates and taxes, levies, maintenance costs and provisions. Below is an example of a cash flow statement of one of my property deals.

| Income | Expense | ||

| Rental | R30 000 | Bond Repayment | R10 500 |

| Parking | R2 000 | Insurance | R450 |

| Rates and Taxes | R8 000 | ||

| Maintenance Provision | R3 000 | ||

| Management Fee | R 3 200 | ||

| Vacancy Provision | R3 000 | ||

| Total: | R32 000 | Total: | R28 150 |

| Cash flow (income – expense) | R3 850 | ||

The above income statement shows that my income (R32 000) is greater than my expenses (R28 150) and I thus have a positive cash flow of R3 850 per month. That is a passive income that comes in whether I work or not.

How many of these deals do you need to become financially free? Everyone has different financial requirements, but most people need +/- R30 000. Meaning that most people need to purchase about 8 of the above properties to become financially free. Not bad hey? The great thing about property is that you can make use of OPM (Other People’s Money).

An explanation of the expenses is broken down below:

- Bond Repayment: this is the payment you make back to the bank on a monthly basis. If you loan R1m from the bank at a 10% interest rate over 20 years, you will pay the bank back R9 650. Not sure how to calculate this? Go to mypropertyapp.online to watch our tutorials or use our calculators

- Insurance: is the payment you make to an insurance company to protect your asset. The most common type of insurance is Building Insurance – which insures your building from external damage. For instance, you can protect your building from being burnt down. If it does burn down, the insurance company will pay for the renovating / rebuilding of the asset.

- Rates and Taxes: is the payment you make to the relevant municipality for water, electricity, utilities and sewerage services.

- Maintenance Provision: this is a set amount of money you put away every month for when maintenance is required.

- Management Fee: this is a fee you pay to a managing agent for managing your property. The managing agent must interview and vet tenants, deal with maintenance issues and evict tenants when needed.

- Vacancy Provision: is a provision you set aside for when the property is empty. A property won’t be fully occupied all year round, so this provision protects you when your property is empty.

Cash flow investing strategies

There are many ways to make money on a cash flow basis, but these three are my favourites.

a. Buy to let

A buy to let is when you purchase 1 house for 1 tenant. For instance, buying a 2-bed apartment in Fourways, JHB would be an example of a buy to let. You have 1 house and you are renting it out to one person/couple/family. This is a great starting strategy as your risk is quite low, but your return is also quite low.

b. Multi-let

This is my personal favourite strategy because it allows you to earn a much bigger cash flow and is also the strategy I wrote my financial book about. A multi-let is when you have 1 house and multiple tenants. For instance, a block of 6 flats would count as a multi-let. This is a great idea because you can get a bulk discount for buying 6 units and your cash flow tends to be a lot higher than with buy to let.

Some things to watch out for; multi-let’s can be safer than a buy to let, because if one tenant defaults, you still have other tenants which can cover your expenses. It can also be riskier, because if you have bad tenants, they can influence the others and create a revolt to not pay. It is common that you can push electricity, water and utility costs onto the tenant on a monthly basis – which again makes it a good strategy for cash flow. Lastly, make sure you are using at least a 10% or more vacancy provision. You tend to have more tenant turnover than your buy to let strategy.

c. Student Accommodation

This is a version of multi-lets. It’s a great opportunity, especially in South Africa because of the high demand of student accommodation. A student accommodation opportunity can be lucrative, but it can be costly if not done correctly.

Some of the things you need to be aware of when investing in student accommodation;

- You need to use a vacancy provision of at least 16% – because most students don’t rent for 2 months over the holiday period. Therefore you need to ensure that your deal still makes a positive cash flow on a 10 month period instead of a 12 month period.

- You need to use at least a 10%+ maintenance provision – because students tend to misuse the property more than professional tenants.

- Ask the estate agent if the rental includes recoveries or not. Recoveries include water and electricity and most often the rental amount includes those figures. For instance, in Brixton, JHB, you can usually rent a room for R2.5k – R3.5k including electricity and water. If the students abuse the water and electricity usage, it will eat into your monthly cash flow and turn your great asset into a draining liability.

Watch: How to prepare yourself to invest in property after lockdown